The Government Human Resource Information System in kenya is an online information system in kenya used mainly by civil servants. We will take you through everything you need to know about the GHRIS, why it matters and how to use it. If you are a civil servant in Kenya and you are not familiar with the GHRIS, you will find all the information you need to know regarding the system. All you have to do is to read carefully and learn how to use the GHRIS easily without any hindrance.

What Is a GHRIS Payslip?

GHRIS payslip stands for Government Human Resource Information System, it is the official salary statement used by the Kenyan Kenya’s government civil servants to view monthly earnings, statutory deductions, net pay, and allowances. It proved a secure online format which is available on the Public Service Payroll portal.

Why GHRIS Payslips Matter?

GHRIS masters as a way of detailing your basic salary, allowances, and deductions, it works (like PAYE, NHIF, NSSF), a GHRIS payslip is important for:

- Loan applications (banks, SACCOs, and more.)

- Tax compliance and preparation (such as KRA P9 forms)

- Financial planning and monthly budgeting

- Proof of employment income for visas or confidential verifications

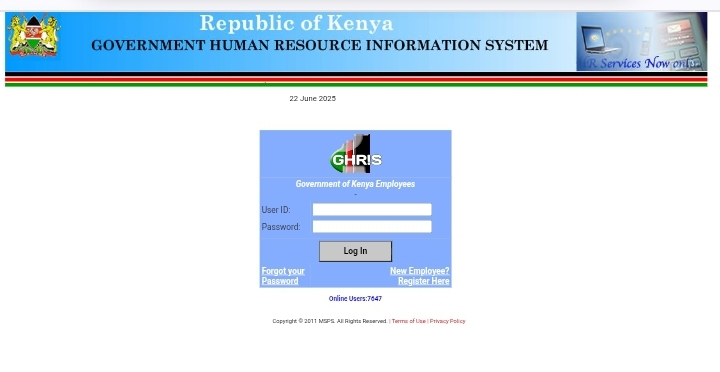

How to Access & Download Your Payslip

Here is a guide on how to access and download your griss pay slip:

- Visit the official GHRIS portal at http://www.ghris.go.ke/registerme.aspx if you are a new user and register on the portal.

- Enter all your information required of you on the registration page and click on the “Submit” button to finally submit your details.

- After successful registration, visit the GHRIS login portal page at http://www.ghris.go.ke/loginonly.aspx and enter your User ID and password to login to your dashboard.

- Navigate to the “Payslips” section upon logging in, go to the “Payslips” or “Leaves & Payroll” section to view current and historical payslips.

- View and download your payslips as PDFs or print directly.

Features of a GRISS Payslip

A griss payslip may include the following:

Employee details such as (name, job title, ID)

Pay period such as the (month and year)

Earnings

Basic salaryHouse, transport, medical, risk allowances

Deductions

PAYE (tax), NHIF & NSSF

Loans, pension contributions

Net pay which may include bank account info, and bonuses

GRISS Tips & Best Practices

Ensure you download your Payslips as early as you can, because they are time-sensitive downloadable on a monthly or quarterly basis.

Cross‑check for any deductions to ensure PAYE rates and NSSF/NHIF rates match government guidelines using reliable calculators like payroll.ke payroll.ke.

Secure your login by using strong passwords when creating accounts and change them periodically if possible.

Use your payslips strategically, they can serve as proof for loans, tax compliance, and personal finance queries.